Getting Out and Staying Out of Tax Debt: 20 Tax Tips and Best Practices

Here Are 20 Practical Tax Tips and Best Practices for Your Tax Resolution

1. Start Early - Begin gathering your tax documents as soon as you can. Don't wait until the last minute to start preparing your tax return. It gives you time to double-check your information and reduce the chances of making mistakes.

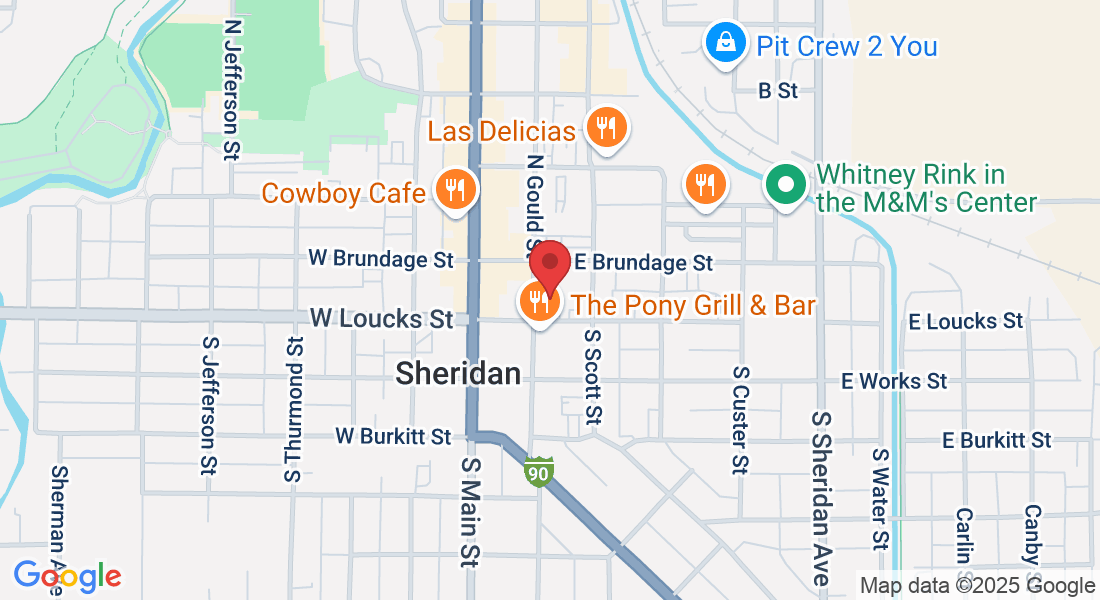

2. Stay Organized Throughout the Year - Keep all your receipts, records, and tax-related documents (W-2s, 1099s, etc.) organized. Use a filing system or an app to track expenses, especially if you’re self-employed or have complex financials.

3. Adjust Your Withholdings - If you consistently owe money at tax time, consider adjusting your W-4 withholdings. If you’re getting large refunds, you may want to decrease your withholding so you get more money in your paycheck throughout the year.

4. Estimate Your Taxes If Self-Employed - If you're self-employed, make estimated tax payments quarterly to avoid underpayment penalties. Use IRS Form 1040-ES for guidance.

5. Keep Track of Deductions - Deductible expenses, such as business expenses, mortgage interest, student loan interest, and medical expenses, can reduce your taxable income. Keep good records to ensure you don’t miss out.

6. Contribute to Retirement Accounts - Contributing to retirement accounts like a 401(k), IRA, or HSA can lower your taxable income, potentially reducing the amount you owe. Plus, it helps you save for the future.

7. Maximize Tax Credits - Make sure you’re taking full advantage of available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, or Education Tax Credits. Credits directly reduce your tax liability.

8. Track Business Expenses - If you're self-employed or run a side business, keep track of all business-related expenses. This can include things like home office expenses, travel, and equipment purchases.

9. Don’t Overlook State Taxes - Many states have their own income tax rules. Be aware of your state’s specific tax obligations to avoid surprises.

10. Keep Tax Documents for 7 Years - Store your tax returns and supporting documents for at least seven years. The IRS can audit returns from previous years, and you may need this information.

11. Hire a Tax Professional - If you’re unsure about your tax situation, especially if you have a complex financial situation (self-employed, rental income, investments), consider hiring a tax professional to ensure you’re maximizing your deductions and not missing any important details.

12. Consider Tax-Advantaged Accounts - Contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA) if eligible. These accounts can reduce your taxable income while helping you save for medical expenses.

13. Avoid Underreporting Income - Always report all income. Underreporting income can lead to penalties, interest, and potential audits.

14. File Your Taxes on Time - Filing late can result in penalties and failing to file at all can cause interest to accrue on unpaid taxes. If you can't pay, file on time and apply for an installment plan.

15. Use Tax Preparation Software - Using reputable tax software can help you catch deductions you might have missed and avoid making mistakes. Many programs also help you file accurately and on time.

16. File Electronically - E-filing is faster, safer, and reduces the likelihood of errors. It also speeds up any refunds you may be due.

17. Check for Special Tax Benefits - If you are eligible for special programs, such as the "First-Time Homebuyer Credit" or tax incentives for energy-efficient home improvements, make sure you claim them.

18. Plan for Major Life Changes - Changes such as marriage, divorce, having a child, or buying a home can significantly impact your tax situation. Plan for these changes ahead of time and adjust your withholding if necessary.

19. Make Charitable Contributions - Donate to qualified charities and keep the receipts. Charitable contributions can often be deducted from your taxable income.

20. Take Advantage of the Standard Deduction - If your itemized deductions are less than the standard deduction, don’t waste time trying to itemize. Take the standard deduction, which may be simpler and result in a larger benefit.